Benbrook auto title loans offer quick cash with less strict credit checks, secured against your vehicle's title. Loan amounts range from $300 to several thousand dollars, with interest-only payments until repayment. Online applications simplify the process. To negotiate better terms, research market value, local rates, and organize financial records. Understanding market rates and leveraging vehicle equity can secure favorable conditions, including quick approval and preservation of your vehicle's value.

Negotiating better terms on Benbrook auto title loans can save you significant amounts of money. This comprehensive guide breaks down the process into manageable steps, starting with understanding the basics of Benbrook auto title loans and ending with advanced tactics to secure favorable conditions. By following our expert tips and strategies, you’ll be well-equipped to navigate the negotiation process successfully, ensuring you get the best deal possible.

- Understanding Benbrook Auto Title Loans: Basics Explained

- Preparing for Negotiation: Steps to Success

- Tactics and Strategies: Getting Better Terms Secured

Understanding Benbrook Auto Title Loans: Basics Explained

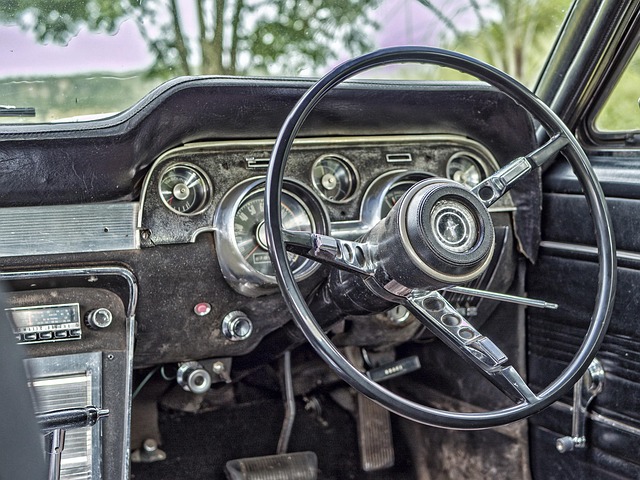

Benbrook Auto Title Loans are a type of secured lending where an individual uses their vehicle’s title as collateral to secure a loan. This alternative financing option is designed for people who need quick access to cash, often with less stringent credit requirements compared to traditional bank loans. The process involves using your car’s registration and ownership documents to establish vehicle equity, which serves as security for the loan.

With Benbrook Auto Title Loans, lenders assess the value of your vehicle, considering factors like its make, model, age, and overall condition. Based on this evaluation, they determine a suitable loan amount, typically ranging from a few hundred to several thousand dollars. Unlike traditional car title loans where you hand over the keys, in Benbrook’s version, you retain possession of your vehicle while making regular interest-only payments until the loan is repaid, at which point the title is returned. An Online Application process makes it convenient for borrowers to initiate the loan inquiry from the comfort of their homes.

Preparing for Negotiation: Steps to Success

Preparing for negotiation when it comes to Benbrook auto title loans is a strategic move that can save you money and ensure better terms. The first step is to educate yourself about the market value of your vehicle; this knowledge empowers you during discussions. Researching local lenders, their interest rates, and the range of offers available for similar title pawn or title transfer transactions will give you leverage.

Additionally, organize your financial records, including income proof and existing loan details, as these documents are crucial in demonstrating your creditworthiness. Being prepared to discuss alternative repayment plans or offering a well-reasoned counterproposal can also sway the negotiation in your favor. Remember, a calm, confident approach will increase your chances of securing more favorable conditions for your auto title loan.

Tactics and Strategies: Getting Better Terms Secured

When negotiating Benbrook auto title loans, understanding your leverage is key. The first step involves thoroughly researching current market rates and terms offered by competing lenders. This knowledge equips you to counter with confidence during negotiations. Don’t be afraid to walk away from a deal if it doesn’t align with your financial goals; a willingness to leave the table can strengthen your position, especially if there are other lenders eager for your business.

Another effective strategy is leveraging the value of your vehicle equity. Secured loans like Benbrook auto title loans offer lower interest rates and flexible terms due to the collateral involved. Emphasize this aspect during negotiations, demonstrating a clear understanding of how it benefits both parties. A well-crafted argument centered around quick approval, reasonable interest rates, and the preservation of your vehicle’s value can lead to better terms secured on your Benbrook auto title loan.

Negotiating better terms on Benbrook auto title loans is within reach with the right preparation and strategies. By understanding the basics of these loans, using effective tactics during negotiations, and keeping your cool, you can secure more favorable conditions for your next car title loan in Benbrook. Remember, knowledgeable consumers are empowered consumers, so do your research, prepare accordingly, and don’t be afraid to advocate for yourself.