Benbrook auto title loans offer quick funding for Fort Worth residents using their car's title as collateral, suitable for those with less-than-perfect credit and unexpected expenses. Eligibility requires meeting criteria like vehicle value, age, credit history, and income, while proof of ownership and detailed vehicle info are needed. Despite good credit not being mandatory, a stable income and vehicle assessment are key to approval.

“Unraveling the eligibility criteria for Benbrook auto title loans can seem daunting, but understanding the process is key to accessing quick funding. This article serves as your guide, breaking down the essential elements that determine loan approval. We’ll explore the fundamentals of Benbrook auto title loans, delve into specific requirements, and provide actionable tips on how to meet them. By the end, you’ll be equipped with the knowledge to navigate this financial option confidently.”

- Understanding Benbrook Auto Title Loans

- Eligibility Criteria for Loan Approval

- How to Meet Requirements for Benbrook Auto Title Loans

Understanding Benbrook Auto Title Loans

Benbrook auto title loans are a type of secured loan where your vehicle’s title serves as collateral. This means that you transfer the ownership of your car temporarily to the lender until the loan is repaid. The process is designed to be straightforward and can provide a quick source of funds for those in need of immediate capital. Fort Worth loans, including Benbrook auto title loans, are popular among borrowers who own free-and-clear vehicles as it offers a simple alternative to traditional bank loans or credit lines.

Unlike other types of loans where strict credit checks may be involved, Benbrook auto title loans evaluate your vehicle’s value and its remaining life, rather than solely relying on your credit score. This makes them accessible to borrowers with less-than-perfect credit history. The lender will determine the loan amount based on the market value of your vehicle, ensuring that both parties are protected. With a clear understanding of the terms and conditions, individuals can use their vehicle collateral to gain access to cash, offering a convenient solution for unexpected expenses or financial emergencies in Fort Worth.

Eligibility Criteria for Loan Approval

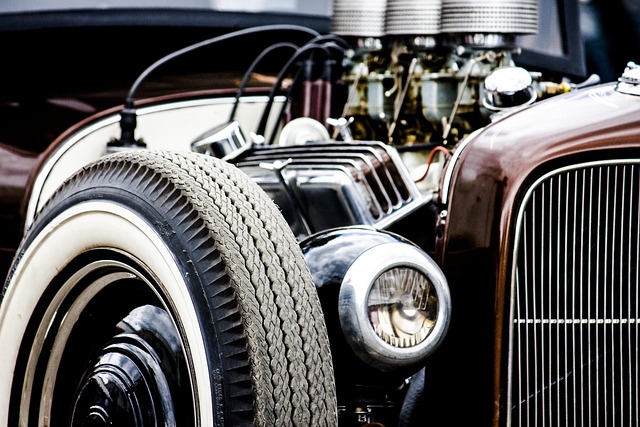

When it comes to Benbrook auto title loans, understanding the eligibility criteria is key to securing the financial support you need. Lenders consider several factors when evaluating loan applications. Firstly, they assess your vehicle’s value and age to ensure it meets their minimum requirements. This process involves a thorough Vehicle Inspection to verify its condition and determine its worth.

Additionally, lenders evaluate your creditworthiness by checking your credit history and debt-to-income ratio. Demonstrating responsible borrowing habits through good credit scores and manageable debt levels can significantly increase your chances of Loan Approval. Lenders also look at your ability to repay the loan, often considering factors like employment status and steady income. Using a Benbrook auto title loan for Debt Consolidation requires a strategic approach to ensure you meet these criteria and gain access to the funds you need without unnecessary stress.

How to Meet Requirements for Benbrook Auto Title Loans

To qualify for Benbrook auto title loans, applicants must meet certain criteria set by the lenders. Firstly, they should be at least 18 years old and have a valid driver’s license to establish their identity and driving eligibility. Additionally, having a stable source of income is crucial as it demonstrates your ability to repay the loan. This can include employment, disability benefits, or any regular monthly earnings. Lenders will also require proof of vehicle ownership; thus, having a clear title for your car is essential for this type of loan.

The application process involves providing detailed information about your vehicle, including its make, model, year, and current mileage. This data helps lenders assess the value of your asset accurately. When it comes to Dallas title loans or any other secured loans, having good credit is advantageous but not always a requirement. Lenders will evaluate your ability to repay based on your income and vehicle details rather than solely relying on credit scores. Ensure you have all the necessary documents ready for a seamless loan approval process.

Benbrook auto title loans offer a unique financing solution, but understanding the eligibility criteria is key to securing approval. By clearly defining the requirements and providing guidance on how to meet them, individuals can navigate this process with confidence. With a straightforward application process and the potential for quick access to funds, Benbrook auto title loans can be a practical option for those in need of immediate financial support. Remember, demystifying these criteria is the first step towards unlocking convenient and accessible funding opportunities.