Benbrook auto title loans offer a flexible and accessible financial solution for individuals with limited or poor credit history, utilizing vehicle titles as collateral. When refinancing, exploring title transfer to a Dallas lender can lead to lower interest rates and terms. Strategically plan by assessing current loan details and comparing multiple lenders to make informed decisions that align with long-term financial goals.

Looking to refinance your Benbrook auto title loan? This guide is your compass. We’ll walk you through understanding Benbrook auto title loans, unlocking the process, and mastering refinancing strategies. Learn how to maximize options, navigate the journey, and steer clear of common pitfalls. With our tips, you’ll make informed decisions and potentially save on interest rates, leaving you in control of your financial future.

- Understanding Benbrook Auto Title Loans: Unlocking the Process

- Strategies for Successful Refinancing: Maximizing Your Options

- Navigating the Refinance Journey: Tips and Common Pitfalls to Avoid

Understanding Benbrook Auto Title Loans: Unlocking the Process

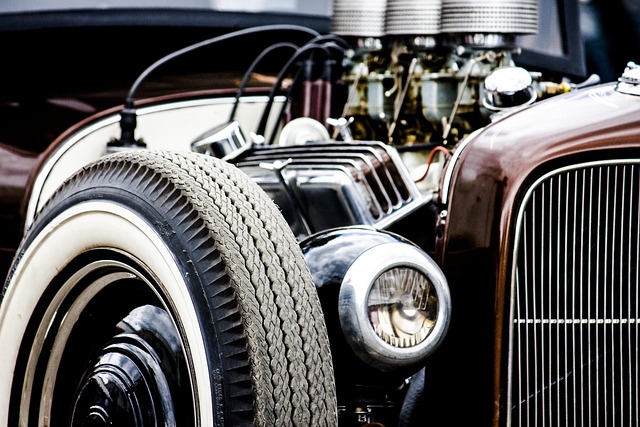

In Benbrook, auto title loans offer a unique financial solution for individuals seeking quick and accessible credit. This type of loan utilizes your vehicle’s title as collateral, allowing lenders to provide funds based on the car’s value. Understanding the Benbrook auto title loans process is crucial before applying. Lenders assess your vehicle’s condition, make, model, year, and overall market value to determine a loan amount. This secured lending option can be advantageous for those in need of financial assistance without a conventional credit history or with less-than-perfect credit.

The title loan process involves several steps. Borrowers must provide valid identification, proof of insurance, and the vehicle’s registration. After verification and appraisal, lenders disburse the funds directly to the borrower. Unlike traditional loans, these plans often come with flexible payment options tailored to suit individual needs, making them a viable choice for many. This alternative financing method can be particularly appealing during unforeseen circumstances or when urgent financial needs arise.

Strategies for Successful Refinancing: Maximizing Your Options

When considering Benbrook auto title loans refinancing, exploring your options is key to success. One effective strategy involves evaluating the potential for a title transfer. This process allows you to replace your existing loan with a new one, often at lower interest rates or terms. By transferring the title to a lender who specializes in Dallas title loans, you might gain significant financial flexibility.

Remember, even with bad credit loans, refinancing could be an achievable goal. Researching lenders who cater to diverse credit profiles is essential. Compare offers from multiple sources, focusing on conditions that align best with your financial situation and goals. This approach can help ensure a successful refinance experience tailored to Benbrook auto title loans.

Navigating the Refinance Journey: Tips and Common Pitfalls to Avoid

Navigating the refinance journey for Benbrook auto title loans requires careful planning and an understanding of the process. Many borrowers find themselves in a position to refinance due to changing financial circumstances or better market conditions. However, it’s essential to approach this decision strategically to avoid common pitfalls. One major trap to steer clear of is assuming that refinancing is always beneficial. Before proceeding, evaluate your current financial situation, including interest rates, existing loans, and flexible payments options offered by lenders. Ensure the refinance saves you money in the long term; otherwise, it might prolong the loan period without substantial gains.

Another common mistake is not exploring all available options thoroughly. The title transfer process can vary among lenders, so comparing different offers is crucial. Look beyond interest rates and consider the overall terms, fees, and reputation of the lender. A reputable lender with a transparent Title Loan Process will prioritize your best interests, ensuring you make an informed decision that aligns with your financial goals, whether it’s to lower monthly payments or shorten loan terms.

Refinancing Benbrook auto title loans can be a strategic move towards financial flexibility. By understanding the process, employing effective refinancing strategies, and navigating potential pitfalls, you can successfully unlock lower interest rates, extended terms, or even cash out. Remember that informed decisions lead to optimal outcomes, so take time to explore your options before committing. With the right approach, you may find yourself with a more manageable loan structure that aligns with your financial goals.