Benbrook auto title loans offer swift financial aid by leveraging your car's equity, with a simple application process requiring personal and vehicle details. Lenders temporarily hold the vehicle's title as collateral, assessing its condition for loan amount determination. Qualification criteria include being 18+, holding a valid license, clear vehicle title, stable income, and minimum credit score. Online applications streamline transactions, enabling quick approval and repayment plans within days, providing an efficient alternative to traditional loans.

Looking to obtain a loan in Benbrook quickly? Benbrook auto title loans offer a straightforward and fast solution. This article guides you through the process, providing an insightful overview of what these loans entail and who can apply. We break down the eligibility criteria and present a simple step-by-step guide to help you secure the funds you need with minimal hassle. Get ready to explore a convenient borrowing option tailored for Benbrook residents.

- Understanding Benbrook Auto Title Loans: A Quick Overview

- Eligibility Criteria for Benbrook Auto Title Loans

- Applying for Benbrook Auto Title Loans: Step-by-Step Guide

Understanding Benbrook Auto Title Loans: A Quick Overview

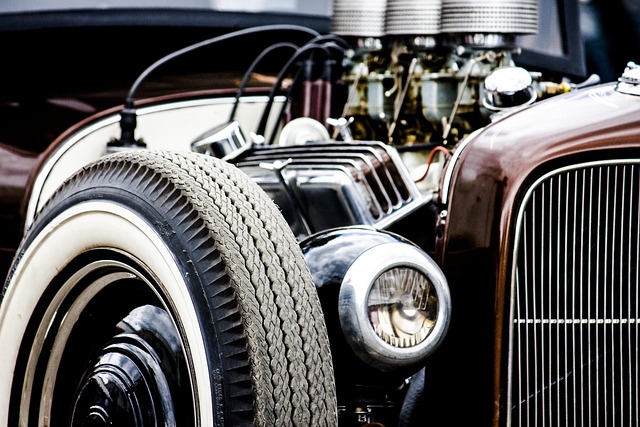

Benbrook auto title loans are a financial solution tailored for vehicle owners looking to access quick cash using their car’s equity. This loan type allows borrowers to use their vehicle’s title as collateral, providing a faster and more straightforward lending process compared to traditional loans. With these loans, individuals can borrow funds based on the value of their automobile, making it an attractive option for those needing immediate financial aid.

The application is usually simple and involves providing personal details, vehicle information, and proof of income. A key step in the process is the title transfer, where the lender temporarily holds your vehicle’s title as security. Once the loan is repaid, the title is returned to you. Some lenders also conduct a vehicle inspection to assess the condition of your car, ensuring it meets certain criteria for the loan amount. This quick overview highlights how Benbrook auto title loans can offer a convenient and efficient way to gain access to much-needed funds.

Eligibility Criteria for Benbrook Auto Title Loans

To be eligible for a Benbrook auto title loan, borrowers must meet certain criteria set by lenders. Typically, applicants should be at least 18 years old and have a valid driver’s license to prove their identity. The vehicle used as collateral for the loan should have a clear title, meaning there are no outstanding loans or liens associated with it. Lenders will also assess the overall condition and value of the vehicle to determine its resale potential if the borrower defaults on payments.

In addition to these basic requirements, lenders may have specific Loan Requirements for Benbrook auto title loans. These often include a stable source of income to ensure borrowers can make regular repayments and a minimum credit score to gauge financial reliability. Online Application processes are designed to be straightforward, allowing applicants to submit their details quickly and securely. This digital approach streamlines the entire process, making it easier and faster for both borrowers and lenders to complete transactions.

Applying for Benbrook Auto Title Loans: Step-by-Step Guide

Applying for Benbrook auto title loans is a straightforward process designed to offer a quick financial solution for those in need. Step one involves gathering all necessary documents, including your vehicle’s registration and proof of insurance. This ensures a smooth evaluation of your vehicle’s collateral value. Next, you’ll connect with a lender who specializes in Benbrook auto title loans; many of these lenders have online applications, making the process even easier.

Fill out the application honestly and accurately, providing details about your vehicle and financial situation. Once submitted, expect a rapid credit check to verify your information. If approved, the lender will outline the terms of the loan, including interest rates and repayment schedules. This entire procedure can be completed within days, offering a practical and convenient Credit Check alternative for immediate financial requirements using your Vehicle Collateral.

Benbrook auto title loans offer a quick and accessible solution for those in need of financial support. By understanding the process, eligibility requirements, and following a simple step-by-step guide, you can apply with ease. This convenient method allows you to leverage the value of your vehicle for immediate funding, making it an attractive option for short-term financial needs.