Benbrook auto title loans offer a quick cash solution for individuals using their vehicle's title as collateral, bypassing credit checks and focusing on vehicle value. The process involves verifying identity, assessing vehicle worth, proving income, and securing funds with minimal time delay. To ensure a positive experience, research licensed lenders in Houston, read reviews, compare rates, and focus on transparent communication, fees, and flexible repayment terms to avoid predatory practices.

Looking for a fast and accessible loan solution in Benbrook? Benbrook auto title loans offer a unique opportunity for borrowers. This article guides you through the process, focusing on how to qualify without the usual headaches. We break down the eligibility criteria, simplify the application steps, and provide tips to steer clear of common pitfalls. By understanding these aspects, you’ll be well-prepared to secure your desired Benbrook auto title loan smoothly.

- Understanding Benbrook Auto Title Loans: Eligibility Criteria

- Simplifying the Application Process: Steps to Qualify

- Avoiding Common Pitfalls: Tips for a Hassle-Free Loan Experience

Understanding Benbrook Auto Title Loans: Eligibility Criteria

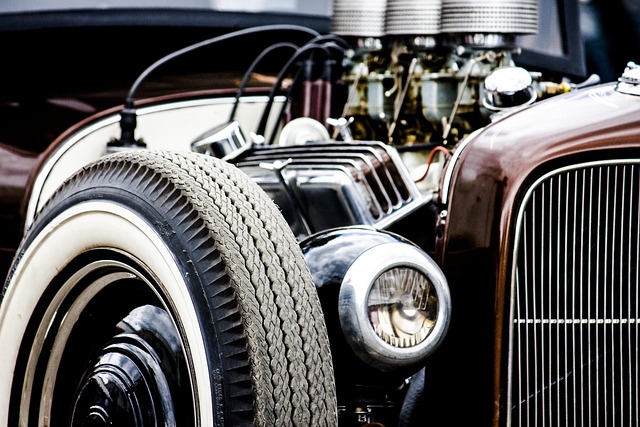

Benbrook auto title loans are a form of secured lending where borrowers use their vehicle’s title as collateral to secure a loan. This type of loan is designed for individuals who need quick access to cash, often for emergency funding or unexpected expenses. Unlike traditional bank loans that heavily rely on credit scores, Benbrook auto title loans focus more on the value and condition of your vehicle than on your credit history.

To qualify for Benbrook auto title loans, borrowers must meet specific eligibility criteria. Lenders typically require a valid driver’s license, proof of vehicle ownership, and a clear vehicle title in good standing. While bad credit loans are possible with this option, lenders will assess the overall value of the vehicle to determine loan approval amounts. The process is generally straightforward, with a quick application, immediate approvals, and direct funding, making it an attractive solution for those seeking emergency funding without the usual stringent requirements.

Simplifying the Application Process: Steps to Qualify

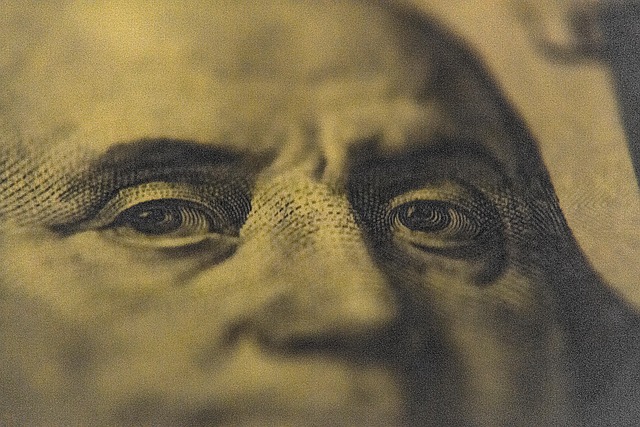

Applying for a Benbrook auto title loan shouldn’t be a complicated process. Lenders who specialize in this type of loan understand that many individuals need quick access to cash, and they’ve streamlined their application procedures accordingly. To simplify things, most lenders only require a few key pieces of information from you. Firstly, they’ll verify your identity using government-issued documents like a driver’s license or passport. Secondly, they’ll assess the value of your vehicle through an online appraisal or inspection to determine the loan amount. This step is crucial as it directly impacts how much money you can borrow against your car’s title.

Once your identity and vehicle are confirmed, the next phase involves proving your income and employment status. This is essential for lenders to ensure that you have a stable source of repayment. In many cases, a simple pay stub or bank statement suffices. Some lenders may also ask for additional documentation, but this varies from one institution to another. Remember, the goal here is to provide clear evidence that you can make timely payments without defaulting on your loan. This quick approval process means you could have the funds in your hands within a short while, making Benbrook auto title loans an attractive option when you need cash fast, especially compared to traditional Houston title loans or other forms of credit with longer waiting times and stringent requirements.

Avoiding Common Pitfalls: Tips for a Hassle-Free Loan Experience

When pursuing Benbrook auto title loans, it’s important to be aware of potential pitfalls that could lead to a frustrating and costly experience. Many individuals fall into common traps, such as dealing with untrustworthy lenders, accepting less-than-favorable terms, or failing to understand the loan process. To avoid these issues, conduct thorough research on reputable lenders offering Houston title loans. Verify their licensing, read customer reviews, and compare interest rates and repayment terms.

Remember, a hassle-free loan experience involves clear communication, transparency in fees, and flexible repayment options tailored to your needs. Prioritizing these factors can help you secure the fast cash you require while ensuring debt consolidation without unnecessary stress.

Benbrook auto title loans can be a convenient solution for those needing quick cash. By understanding the eligibility criteria, simplifying the application process, and avoiding common pitfalls, you can qualify for these loans without hassle. Remember, clear title ownership and a reliable vehicle are key requirements. With the right preparation, you’ll be on your way to securing the funds you need promptly.