Benbrook auto title loans offer higher loan amounts and flexible terms for individuals with less-than-perfect credit. Refinancing these loans strategically saves money by securing better interest rates and repayment schedules, aligning them with financial goals. To maximize savings, compare lenders, understand current loan terms, shop around for quotes, consider vehicle value and market rates, and explore diverse options like Boat Title Loans.

Looking to refinance your Benbrook auto title loan? Navigating this process can seem complex, but understanding the basics is key. This comprehensive guide breaks down ‘Understanding Benbrook Auto Title Loans’ and provides a clear roadmap through ‘Steps to Refinance’, ensuring a smoother journey. Learn effective ‘Maximizing Savings’ strategies to secure better terms and reduce costs. With these insights, you’ll be well-equipped to make informed decisions regarding your Benbrook auto title loans refinancing.

- Understanding Benbrook Auto Title Loans: A Comprehensive Overview

- Steps to Refinance: Simplifying the Process for Better Terms

- Maximizing Savings: Strategies for Successful Loan Refinancing

Understanding Benbrook Auto Title Loans: A Comprehensive Overview

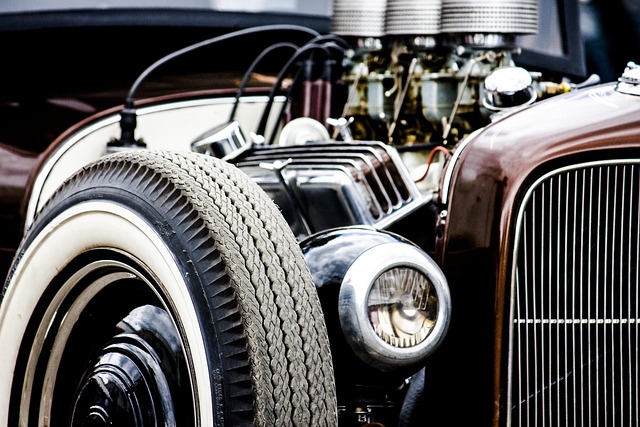

Benbrook auto title loans are a unique form of secured lending where borrowers use their vehicle’s title as collateral to secure a loan. This type of financing is designed for individuals who need quick access to cash, offering relatively higher loan amounts compared to traditional personal loans. The process involves providing the lender with your vehicle’s registration and title, which they hold until the loan is fully repaid. Benbrook auto title loans cater to those with less-than-perfect credit or a limited credit history, as the focus is primarily on the value of the collateral rather than strict credit checks.

These loans provide a viable option for borrowers seeking immediate funding. With competitive interest rates and flexible repayment terms, loan refinancing can be a strategic move to manage existing debt or access better terms. Secured loans like Benbrook auto title loans often come with lower interest rates because the lender mitigates risk by retaining ownership of the vehicle’s title. Loan refinancing allows borrowers to negotiate new terms, potentially reducing monthly payments and overall interest expenses, making it an attractive strategy for financial optimization.

Steps to Refinance: Simplifying the Process for Better Terms

Refinancing Benbrook auto title loans can be a strategic move to secure better terms and save money in the long run. The process involves several key steps that, when followed diligently, can help borrowers achieve favorable refinancing outcomes. First, compare different lenders offering motorcycle title loans or San Antonio loans to identify those with competitive rates and flexible repayment plans. This step ensures you get the best deal possible.

Once you’ve selected a lender, prepare necessary documentation, including proof of income, vehicle registration, and insurance. Next, review the new loan terms carefully, understanding interest rates, fees, and repayment schedules. Ensure these align with your financial goals and budget before finalizing the refinance agreement. By taking these measures, borrowers can successfully navigate the refinancing process, potentially lowering their monthly payments and shortening their loan term for Benbrook auto title loans.

Maximizing Savings: Strategies for Successful Loan Refinancing

Maximizing Savings: Strategies for Successful Loan Refinancing

When considering Benbrook auto title loans refinancing, one of your primary goals should be to save money in the long run. Start by thoroughly understanding your current loan terms and conditions. Compare interest rates, repayment periods, and any hidden fees offered by different lenders. This knowledge will empower you to negotiate better terms during the refinance process. A simple yet effective strategy is to shop around for quotes from multiple lenders specializing in Benbrook auto title loans. This competitive market approach can lead to significant savings on your refinancing costs.

Additionally, consider the value of your vehicle and the current market rates. Lenders often assess the condition and resale value of your vehicle during the loan approval process. If your car has undergone maintenance or repairs since the original loan, highlight these updates to potentially secure a lower interest rate. Remember, a thorough Vehicle Inspection can reveal unexpected savings opportunities. Similarly, exploring alternatives like Boat Title Loans might offer different refinancing options with varying conditions, allowing you to choose the most cost-effective path for your situation.

Refinancing Benbrook auto title loans can be a strategic move to improve your financial situation and gain better terms. By understanding the process, taking calculated steps, and employing strategies for maximizing savings, you can successfully navigate the refinancing journey. Remember that each lender may have unique offerings, so comparing options is key. With the right approach, you could achieve lower interest rates, extended repayment periods, or even cash back, ultimately saving money and easing your financial burden.